Record Retention

What’s the Magic Number When it Comes to Record Retention?

You don’t need to be a magician to know what records to keep and for how long. While most providers can supply

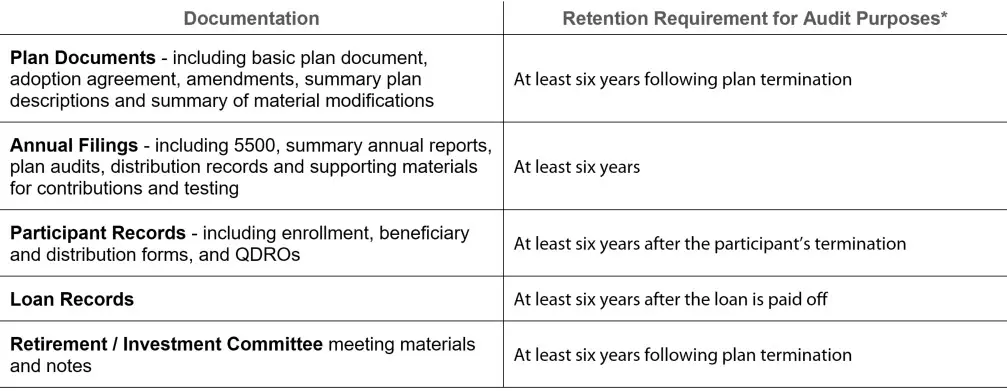

reports and plan documents, the plan administrator remains ultimately responsible for retaining adequate records that support the plan document reports and filings. Refer to the chart below to know which documents you need to keep in case of a plan audit.

Organization of Your Fiduciary File

When organizing your fiduciary file, we recommend a format that includes the following sections:

- Documents – all plan documents, amendments, tax filings, etc.

- Administrative – all audit results, contribution records, Fiduciary Plan Review meeting minutes, fee benchmarkings, participant complaints

- Participant Education – copies of enrollment materials, memos, meeting sign-in sheets

- Investments – fund menu list with expenses, Fiduciary Investment Review meeting minutes

Questions?

Michael Del Re III, AIF®, ChFC®, REBC®

mjdelreiii@fnlonline.com

203.878.8194

fnlonline.com

About Financial Network Limited

FNL was founded to provide personalized investment strategies for individuals and families, and distinctive employee benefit programs for employers. For more than 25 years, we have thrived as an independent, family-owned and operated firm with a consistent mission – to provide comprehensive and innovative client solutions with the highest levels of professionalism and integrity.

*For litigation purposes, we recommend that documents be retained indefinitely.