Download the Target Date Fund Questionnaire!

This Target Date Fund Guide will help you:

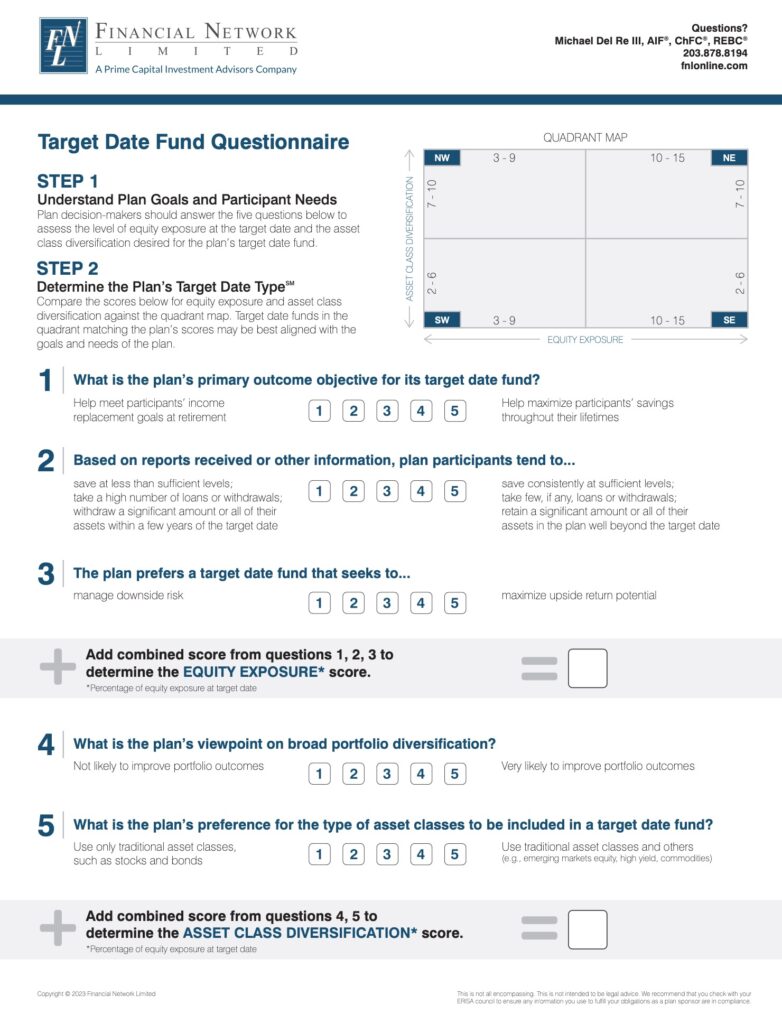

- Understand Your Plan Goals and Participant needs

- Determine the Plan’s Target Date Type

- And more!

What is a Target Date Fund?

Target date funds are a type of mutual fund designed to be a long-term investment for individuals planning for a particular retirement date or another specific financial goal that is date specific. These funds are not guaranteed to provide sufficient retirement income or otherwise reach a specific financial goal by the date in their name. Instead, Target Date Funds automatically adjust their asset allocation over time based on the target retirement or investment date.

Here’s how target date funds typically work:

- Target Date: Each fund has a specific target date associated with it and is identified in its name. This date corresponds to an investor’s expected retirement date or another financial goal. Oftentimes, each fund in a target date suite is referred to as a vintage (i.e. 2035, 2040, 2060, et al). It is important to note that vintages with the same target date managed by different investment providers are likely to have different investment strategies, different levels of risk, different fees and therefore, different investment performance.

- Asset Allocation: A target date fund’s investments are diversified across various asset classes, such as stocks, bonds, and cash. The asset allocation is initially more growth-oriented, with a higher percentage in stocks, and over time (as the target date gets closer) gradually shifts toward bonds and cash. Some mutual fund firms describe this process as getting a complete portfolio in a single fund but it is important to remember that all investments have some level of risk, regardless of whether they are stocks, bonds, or something else. Even with the same type of investment, some stocks have less risk than other stocks, and some bonds have more risk than other bonds. Although bonds are often considered to be less risky than stocks, some types of bonds may be riskier than stocks.

- Automatic Rebalancing: As the target date approaches, the fund automatically adjusts its asset allocation to reduce risk and become more conservative. This process is known as rebalancing and is based upon a glide path (how quickly a target date fund adjusts to become more conservative and which asset classes are employed) that is unique to each investment company that constructs & manages target date funds.

Target date funds are designed to provide a “set it and forget it” approach for investors who may not want to actively manage their portfolio or do not have the expertise or time to regularly monitor and adjust their investments. These funds offer convenience and a glide path that aligns with an investor’s changing risk tolerance and financial needs as they approach their target date.