SECURE ACT 2.0: Information for Employers

The SECURE Act 2.0, or Setting Every Community Up for Retirement Enhancement Act, is a comprehensive piece of legislation benefiting both Individuals and Employers. This legislation is set to be implemented over the next several years and seeks to foster a stronger and more secure retirement landscape for Individuals while offering financial support to Employers to offer retirement plan benefits while also extending the time before investors become subject to required minimum distributions from their retirement portfolios.

For Employers, it simplifies the process of offering retirement plans, providing tax incentives and credits to establish or enhance retirement benefits. It extends plan eligibility to part-time employees and also provides additional flexibility for Sponsors of non-ERISA Plans (i.e., Simple IRAs) to offer greater matching contributions.

Information for Employers Establishing New Plans

The SECURE Act 2.0 significantly aids Employers in establishing new retirement plans by simplifying administrative burdens and associated costs, particularly benefiting small businesses. The Act offers tax credits to offset the setup costs of new retirement plans, incentivizing Employers to provide these essential benefits. Additionally, it requires the automatic enrollment of employees into retirement plans, promoting higher participation rates and ultimately helping employees save for their future. By streamlining regulatory processes and providing financial incentives, SECURE Act 2.0 empowers Employers to take meaningful steps in offering retirement plans and fostering a more financially secure future for their employees.

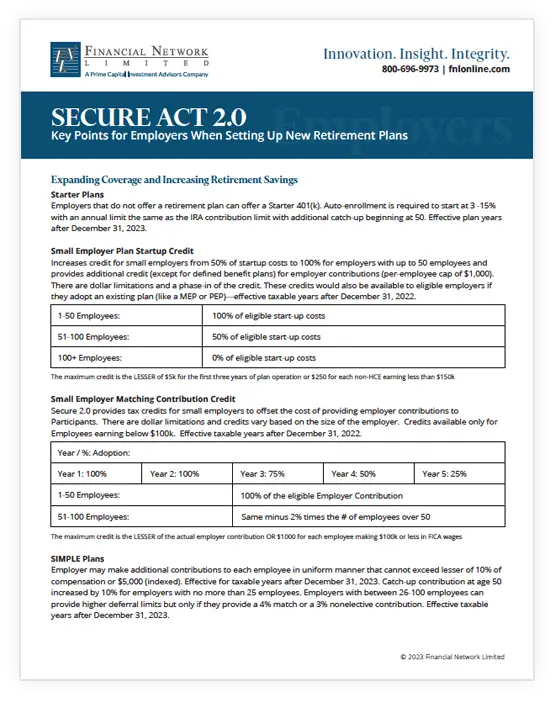

This download covers the following topics for Employers looking to start new Plans:

- Small Employer Plan Startup Credit

- Small Employer Matching Contribution Credit

- SIMPLE Plans

Don’t miss out on the opportunity to enhance your company’s retirement plan and stay ahead in providing valuable benefits to current and future employees. Contact us today for expert assistance in navigating the complexities of the SECURE Act.

Retain employees with a comprehensive retirement plan. Contact us today for a free evaluation of your plan.

Information for Employers with Existing Plans

The SECURE Act 2.0 brings advantages to Employers with existing retirement plans by encouraging the inclusion of lifetime income options within retirement plans. This gives Employers the opportunity to offer more diversified and reliable options to their employees, ensuring a steady income during retirement. The SECURE Act represents an opportunity for Employers to enhance their current retirement offerings in order to provide better financial prospects for their employees in their post-work years.

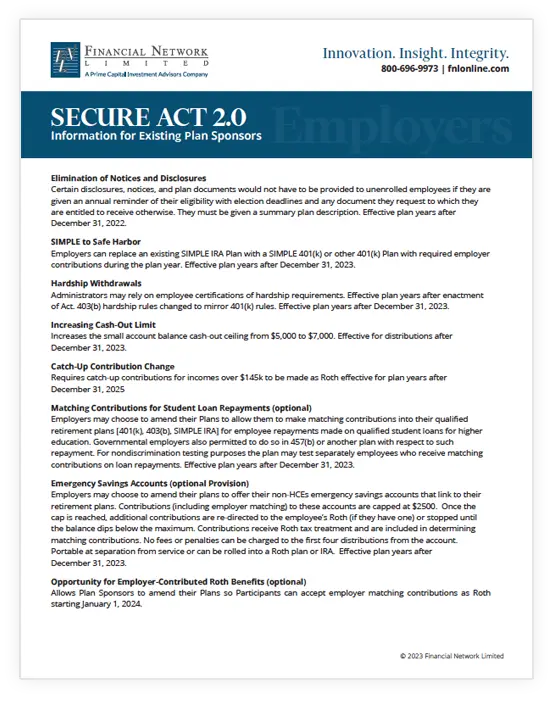

This guide covers the following topics for employers with existing Plans:

- Elimination of Notices and Disclosures

- SIMPLE to Safe Harbor

- Hardship Withdrawals

- Catch-Up Contribution Change

- Opportunity for Employer-Contributed Roth Benefits

- And more

Are you prepared to optimize your retirement benefits under the SECURE Act and enhance your employee offerings? Take the proactive step towards securing a brighter financial future for both your employees and your business. Contact us today for expert assistance in navigating the complexities of the SECURE Act.