Three Tax Tips that Can Help as You Approach or Begin Retirement

Retirement is a whole new phase of life. You’ll experience many new things, and you’ll leave others behind – but what you won’t avoid is taxes. If you’ve followed the advice of retirement plan consultants, you’re probably saving in tax-advantaged retirement accounts.

No Beneficiary Designation. Who Gets The Money?

According to a recent Wall Street Journal article, retirement plans and IRAs account for about 60 percent of the assets of U.S. households investing at least $100,000.¹ Both state and federal laws govern the disposition of these assets, and the results can be complicated, especially when the owner of the account has been divorced and remarried. Therefore, it is important for plan fiduciaries of qualified retirement plans to understand their role regarding beneficiary designations and the regulations that dictate.

6 Ways to Reduce Fiduciary Liability

In 2020, nearly 100 lawsuits alleging breach of fiduciary duty were filed. And with the number of 401(k) lawsuits on the rise targeting plans both large and small, sponsors are well-advised to consider taking additional measures to mitigate fiduciary risk where practicable. Here are a few to consider.

No Surprise Billing Interim Final Regulations – Part 1

On July 1, 2021, the U.S. Departments of Health and Human Services, Labor, and Treasury, along with the Office of Personnel Management (collectively, the Departments), issued an interim final rule (IFR) to explain provisions of the No Surprises Act (the Act) that passed as part of sweeping COVID-19 relief legislation signed in December 2020. The Act and IFR aim to protect consumers from excessive out-of-pocket costs resulting from surprise and balance medical billing. This Advisor provides a high-level summary of the IFR.

401(k) Plan Tax Credit Summary

Eligible employers may be able to claim a tax credit of up to $5,000, for three years, for the ordinary and necessary costs of starting a SEP, SIMPLE IRA or qualified plan (like a 401(k) plan.) A tax credit reduces the amount of taxes you may owe on a dollar-for-dollar basis.

Participant Corner: Tax Saver’s Credit Reminder

You may be eligible for a valuable incentive, which could reduce your federal income tax liability, for contributing to your company’s 401(k) or 403(b) plan. If you qualify, you may receive a Tax Saver’s Credit of up to $1,000 ($2,000 for married couples filing jointly) if you made eligible contributions to an employer sponsored retirement savings plan. The deduction is claimed in the form of a non-refundable tax credit, ranging from 10% to 50% of your annual contribution.

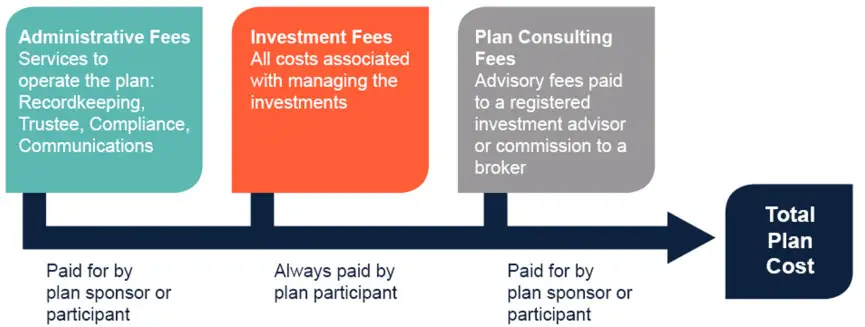

Retirement Plan Fees

Retirement plan fees are complicated. Between administration, investment management, recordkeeping, consulting, revenue sharing, sub-TA and 12b-1, it isn’t always clear to plan participants or plan sponsors exactly what they’re paying, how much they’re paying or even who’s paying the fees.

Keep Your Plan Assets Safe

Cyber fraud is a growing concern globally. Individuals are typically very careful to keep their bank account and email authentication information safe, but they aren’t always smart with the rest of their personal information.

Target Date Funds—Does One Size Really Fit All?

If you have ever opened a brokerage account with an advisor, you know the first step is gathering information to determine the risk profile and appropriate investment allocation for the individual.

QDIA…Why is it important?

The qualified default investment alternative (“QDIA”) is arguably the most important investment in a plan’s investment menu. By far the most often selected QDIA investment is a target date fund (“TDF”). TDFs are typically the only investment selection that offers unitized professionally managed portfolios that reflect the participants’ time horizon today and as they go to and through retirement.